When Are The Feds Going To Cut Rates And By How Much?

We’ve all been anticipating the ripple effects of the Fed’s rate cuts, and the real estate market is buzzing with excitement for what lies ahead in 2024. The big question on everyone’s mind is not just when these rate cuts will happen, but by how much? Let’s delve into the projections and insights that are shaping the mortgage landscape.

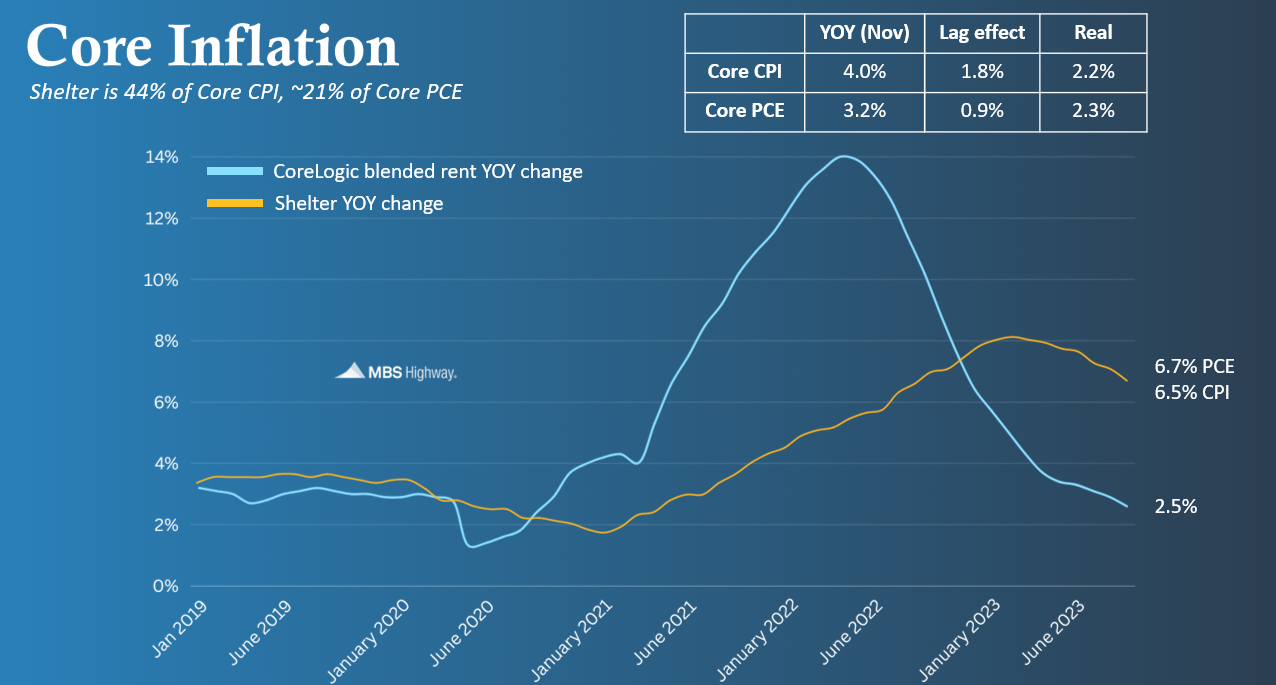

At the December meeting, the Fed projected a decline in the federal funds rate to 4.6% from the current target range of 5.25%-5.5%. Barry Habib and MBS highway, reliable sources for rate and market updates, suggest that by March, and particularly by May, we could be approaching the coveted 2% inflation rate, paving the way for the anticipated Fed rate cuts.

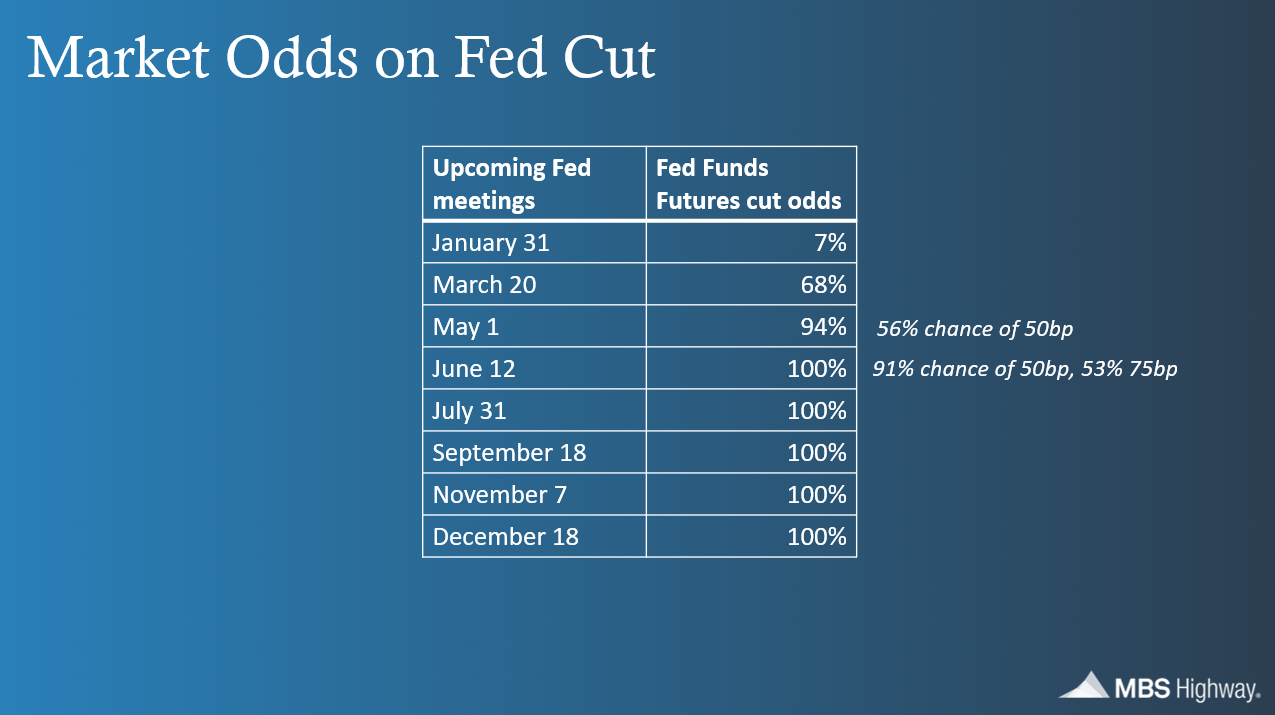

In the world of finance, much like in Fantasy Football, there are odds makers. As we step into January, there’s a 7% chance, but the odds significantly rise by March 20th, making a rate cut seem almost certain by May. Some speculations even point to the possibility of three rate cuts by June 1st, indicating a potential trio of favorable adjustments by July.

A glance at the Fed Dot Plot, showcasing 19 dots, each representing a Fed member, reveals an interesting shift. While in 2023, all 19 members aimed for a Fed Funds rate of 5.5%, the plot for 2024, 2025, and 2026 suggests a prolonged period of low rates. This signals a more extended era of favorable rates in the coming years.

What does this mean for homeowners and prospective buyers? According to Doug Duncan, Fannie Mae’s Senior Vice President and Chief Economist, “In 2024, we expect home sales and mortgage origination activity to begin a gradual recovery in the presence of a slow-growing economy.” This positive outlook is fueled by the decline in inflation and the Fed’s signaling of future rate cuts.

Duncan predicts mortgage rates to dip below 6% by the end of 2024, offering a boost to affordability. Homebuilders are expected to continue adding new supply, further aiding accessibility. The decline in mortgage rates is likely to drive refinancing volumes up, along with a potential uptick in purchase financing.

So, what’s your next move in this evolving mortgage landscape? Don’t hesitate to reach out. The opportunities are unfolding, and informed decisions today can pave the way for a brighter and more affordable tomorrow.

Here are some related links:

Get a FREE Copy of my Book – The Cash Out Refinance Book

https://freshhomeloan.com/the-cash-out-refinance-book-get-your-complimentary-copy/

Homebuyers, How to Win in a Challenging Housing Market

https://freshhomeloan.com/the-fresh-home-loan-home-buyers-concierge-program/

Accessory Dwelling Units in the Bay Area and How to Navigate Financing Options

As an Independent Mortgage Broker, in the business for 20+ years, we have the experience, the options, and the wholesale rates to help you navigate through these tumultuous times. Feel free to contact Garrick Werdmuller and his team at:

You may also contact Garrick Werdmuller Directly:

Garrick Werdmuller

President CEO

Fresh Home Loan Inc

510.282.5456 call/text

NMLS 242952

If you would like to get social:

All loan approvals are conditional and not guaranteed and subject to lender review of all information. Loan is conditionally approved when lender has issued approval in writing, but until all conditions are met, loan cannot be funded. Specified rates and [products may not be available to all borrowers. Rates subject to change according to market conditions and agreed upon lock times set by borrower. Fresh Home Loan Inc. is an Equal Opportunity Mortgage Broker in California. This licensee is performing acts for which a real estate license is required. Fresh Home Loan, Inc. is licensed by the California Department of Real Estate #02137513 NMLS # 2124104

The post When Are The Feds Going To Cut Rates And By How Much? appeared first on Fresh Home Loan.