by liftoffalpha | Mar 30, 2024 | 411

As an “Independent Mortgage Broker that Works for the People”, Private Money, or HARD MONEY is in constant demand. Garrick Werdmuller, President and CEO of Fresh Home Loan has been brokering Private Money deals since 2008. “Back then, many investors could only get...

by liftoffalpha | Feb 27, 2024 | 411

The Fresh Home Loan Home Buyers Concierge Program is an exclusive program from Fresh Home Loan Inc. California’s Premier Mortgage Brokerage. We have been working with First Time Home Buyers, Move Up Home Buyers, Move Down Home Buyers, and Investors for 20+ years and...

by liftoffalpha | Feb 7, 2024 | 411

The San Francisco Bay Area, known for its stunning landscapes, technological innovation, and cultural diversity, faces a growing challenge in its housing market. As housing costs soar and urban spaces become more limited, residents and policymakers alike are exploring...

by liftoffalpha | Jan 23, 2024 | 411

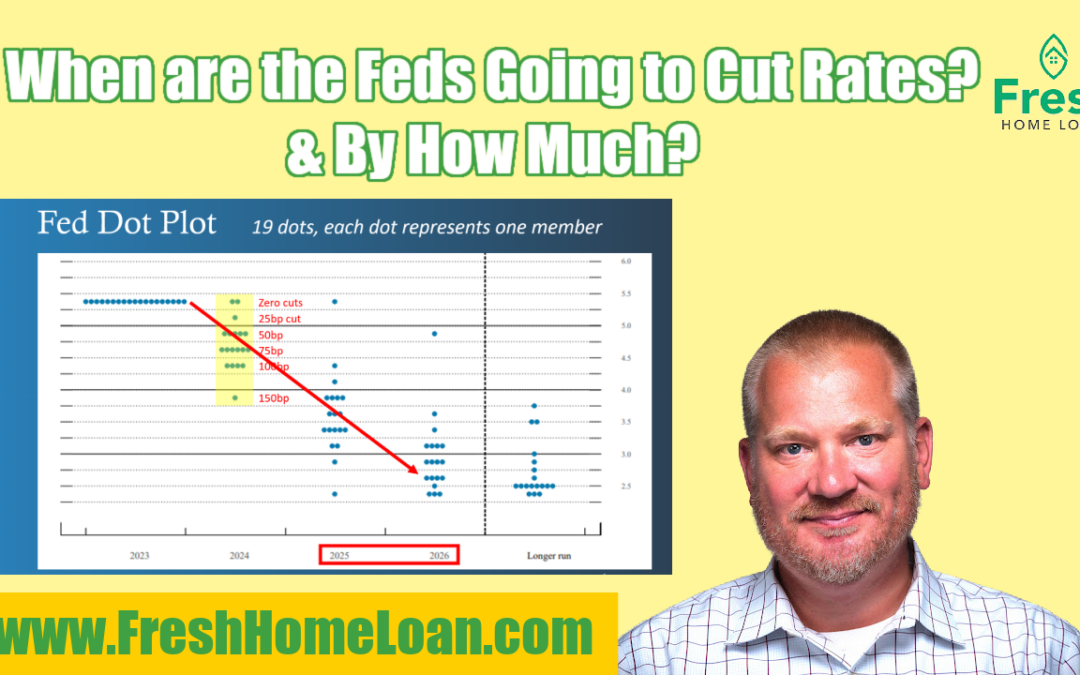

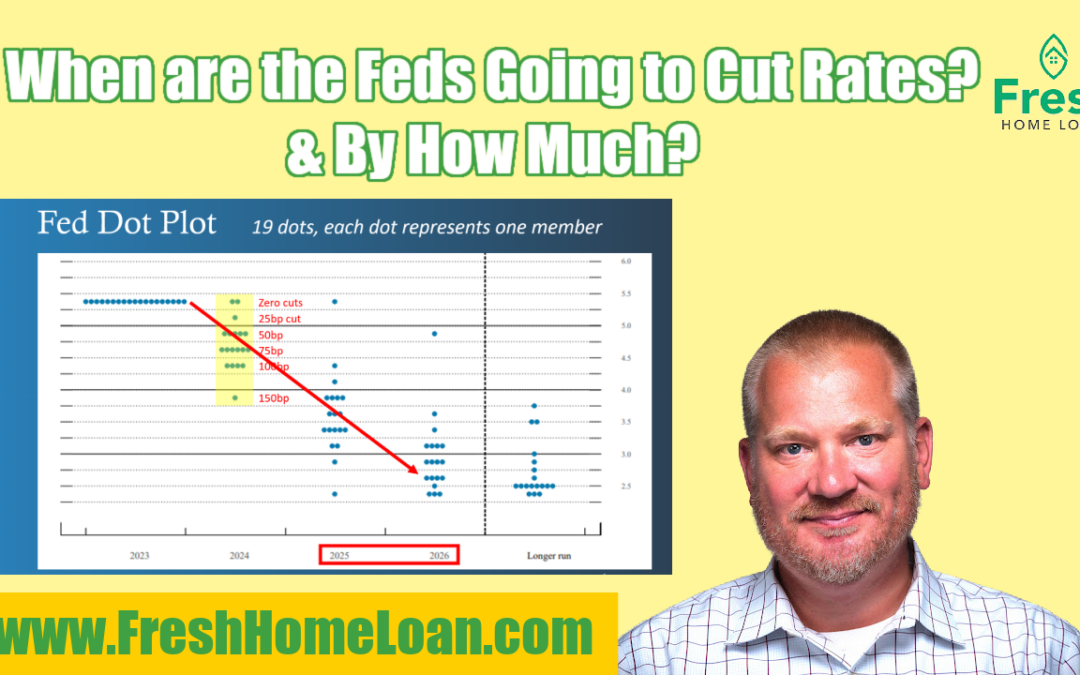

We’ve all been anticipating the ripple effects of the Fed’s rate cuts, and the real estate market is buzzing with excitement for what lies ahead in 2024. The big question on everyone’s mind is not just when these rate cuts will happen, but by how...

by garrick | Nov 16, 2023 | 411

Are you in the market for a new home or looking to refinance your existing mortgage? Now is the perfect time to seize an incredible opportunity with The 1-0 Buy Down and enjoy a special $600 Appraisal Credit until March 31, 2024. This exclusive offer is brought to you...

by garrick | Nov 14, 2023 | 411

The San Francisco Bay Area, known for its stunning landscapes, technological innovation, and cultural diversity, faces a growing challenge in its housing market. As housing costs soar and urban spaces become more limited, residents and policymakers alike are exploring...

Recent Comments