By Garrick Werdmuller

•

February 11, 2026

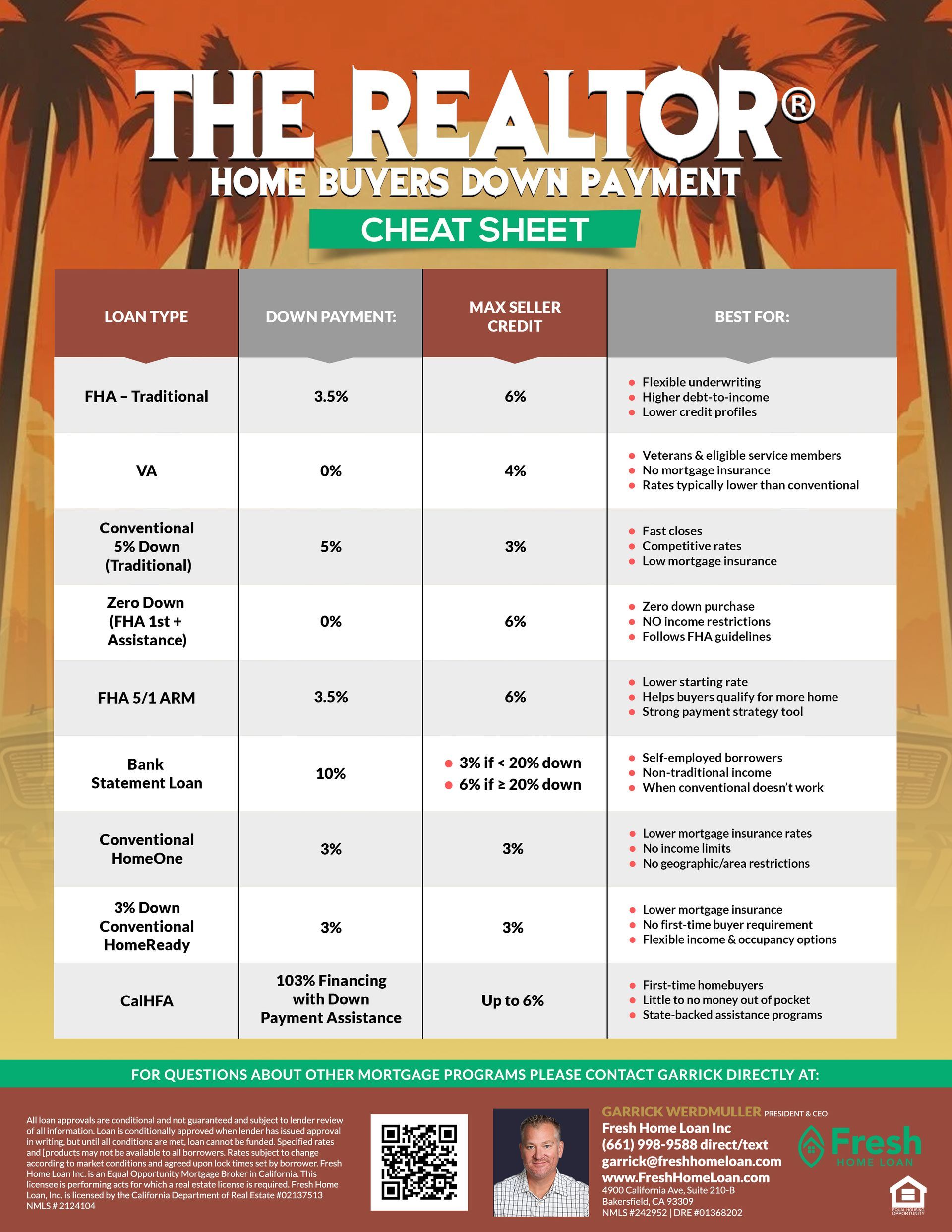

If you’re trying to buy a home in California and down payment is the biggest hurdle, the California Housing Finance Agency (CalHFA) Dream For All Shared Appreciation Loan Program may be one of the most powerful opportunities available. Fresh Home Loan Inc., led by Independent Mortgage Broker Garrick Werdmuller (DRE #01368202 | NMLS #242952) , has released a comprehensive preparation guide to help California homebuyers position themselves for the next round of funding under the California Housing Finance Agency (CalHFA) Dream For All Shared Appreciation Loan Program. To apply visit: https://www.freshhomeloan.com/apply-now With affordability remaining one of the most pressing challenges across California, the Dream For All Program has generated significant attention by offering down payment assistance in exchange for a share of future appreciation. Previous funding rounds were depleted quickly, highlighting the importance of preparation and strategic financial positioning. “The Dream for All Program gets a lot of attention and hype. This is a great program; however, buyers should know it is an equity share and it is a lottery with limited funds and a short window. It’s a great opportunity to take advantage of it but it should deter a home buyer from getting a home if you don’t win the lottery. “says Garrick Werdmuller, President and CEO of Fresh Home Loan. How the Shared Appreciation Works You Receive Down Payment Assistance CalHFA provides a second loan that helps cover your down payment (and sometimes closing costs). No monthly payments Deferred repayment Recorded as a lien on the property You Repay When a Trigger Event Happens Repayment occurs when you: Sell the home Refinance the first mortgage Pay off the loan Transfer ownership At that time, you repay: The original assistance amount PLUS a percentage of the home’s appreciation What Percentage Do They Take? The percentage of appreciation owed depends on your income level at the time you received the assistance. Historically: Lower-income borrowers → Lower share of appreciation Higher-income borrowers → Higher share of appreciation (Exact percentages depend on the program year and funding round.) 📊 Example Scenario Let’s say: Purchase price: $500,000 Assistance received: $100,000 You sell later for: $650,000 Appreciation: $150,000 If your equity share percentage was 20%, you would repay: $100,000 (original assistance) 20% of $150,000 ($30,000) = $130,000 total repayment You keep the remaining appreciation. Understanding Shared Appreciation With Dream For All, assistance is repaid when you: Sell the property Refinance Transfer ownership Repayment includes the original assistance amount plus a share of the home’s appreciation. Understanding how shared appreciation works is critical before committing to the program. Strategic planning ensures the program fits your long-term goals. Who Is the Dream For All Program Designed For? The program is generally intended for: First-time homebuyers Moderate-income California residents Buyers who meet CalHFA income limits Borrowers completing required homebuyer education Eligibility requirements and income limits vary by county, so reviewing guidelines early is key. How to Prepare for Dream For All Funding Here’s what serious buyers should be doing right now: Optimize Your Credit Profile Your credit score directly impacts loan approval and structure. Review credit reports Pay down revolving debt Avoid new credit inquiries Dispute inaccuracies Even small improvements can strengthen your file. Organize Income Documentation Prepare: Two years of tax returns (if applicable) W-2s or 1099s Recent pay stubs Bank statements Asset documentation Self-employed buyers should prepare profit-and-loss statements and business bank records. Complete Required Homebuyer Education CalHFA typically requires completion of a certified homebuyer education course. Completing this early avoids delays when funding opens. Secure a Strong Pre-Approval Not all pre-approvals are equal. A structured, document-reviewed pre-approval strengthens your offer when competing in a fast-moving market. Apply here: https://www.freshhomeloan.com/apply-now At Fresh Home Loan, we focus on: Clean file structuring Upfront documentation review Accurate DTI calculation Clear purchase strategy Why Preparation Matters in California’s Housing Market California remains one of the most competitive real estate markets in the country. When assistance programs open: Buyers rush to apply Inventory tightens Sellers favor clean, well-structured offers Preparation reduces stress, shortens timelines, and increases negotiating strength. Take the Next Step Toward Homeownership If you’re serious about buying in California, preparation starts now. Fresh Home Loan Inc. serves clients across the Bay Area and Central Valley, providing strategic mortgage planning and structured pre-approvals designed for competitive markets. Garrick Werdmuller Independent Mortgage Broker DRE #01368202 | NMLS #242952 📞 510-282-5456 🌐 https://www.freshhomeloan.com For more information give me a call at 510.282.5456 or visit: https://freshhomeloan.com/schedule-a-meeting/ All loan approvals are conditional and not guaranteed and subject to lender review of all information. Loan is conditionally approved when lender has issued approval in writing, but until all conditions are met, loan cannot be funded. Specified rates and [products may not be available to all borrowers. Rates subject to change according to market conditions and agreed upon lock times set by borrower. Fresh Home Loan Inc. is an Equal Opportunity Mortgage Broker in California. This licensee is performing acts for which a real estate license is required. Fresh Home Loan, Inc. is licensed by the California Department of Real Estate #02137513 NMLS # 2124104 # FreshHomeLoan # DreamForAll #CalHFA #CaliforniaHomebuyers #DownPaymentAssistance #FirstTimeHomeBuyer #HomeownershipGoals #MortgageBrokerCA #GarrickWerdmuller #CaliforniaRealEstate #BuyAHomeCA #HomeBuyerTips #MortgagePlanning #RealEstateFinance #BayAreaHomes #HomeLoanHel p