As Rates Creep up in 2022 the FHFA Hikes Fees for High-Balance and Second-Home Loans!

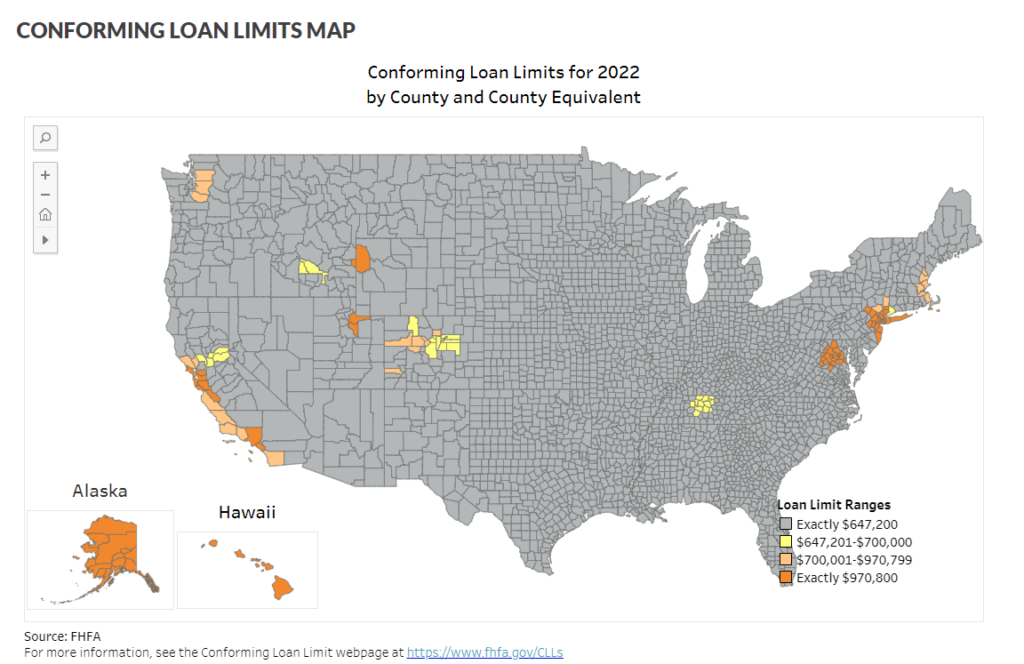

The FHFA announced some pretty dramatic fee increases for high balance and second home financing. They are implementing loan-level price adjustments on April 1 st, 2022 that affect home buyers and homeowners in high-cost areas like the San Francisco Bay Area and people buying vacation homes.

“These targeted pricing changes will allow the Enterprises to better achieve their mission of facilitating equitable and sustainable access to homeownership while improving their regulatory capital position over time,” said Director Sandra L. Thompson “Today’s action represents another step FHFA is taking to strengthen the [GSEs’] safety and soundness and to ensure access to credit for first-time home buyers and low- and moderate-income borrowers.”

Loans to first-time home buyers in high-cost areas with incomes at or below 100 percent of area median income will not have specific high balance upfront fees as well as affordable housing programs. To meet that criteria it can be challenging to qualify for a high balance loan in general.

While the Mortgage Bankers Association President Bob Broeksmit said he appreciated the delivery date for the new fees is in April, which gives lenders more than 90 days to adjust their rate sheets appropriately, there hadn’t been a lot of backlash when this change seems like the White House is targeting homeowner in high cost areas. When a 1300 square foot home in San Mateo Ca. goes for 1.4M, it seems hardly fair to charge this family an additional $10,921.50 (that’s what they will charge) to get the maximum loan amount of $970,800.

High balance loan limits were put in place to help the common homeowner and homebuyers during the financial meltdown. These are not loans for the elite 1% as Sandra Thompson and the FHFA make them out to be. For an Administration that is so concerned with discrimination, it seems hardly right to charge those living in high-cost areas higher fees. Highly democratic high-cost areas at that. That is discrimination in itself. It will be interesting how this plays out.

The post As Rates Creep up in 2022 the FHFA Hikes Fees for High-Balance and Second-Home Loans! appeared first on Fresh Home Loan.