by jessicajones | Sep 21, 2022 | 411

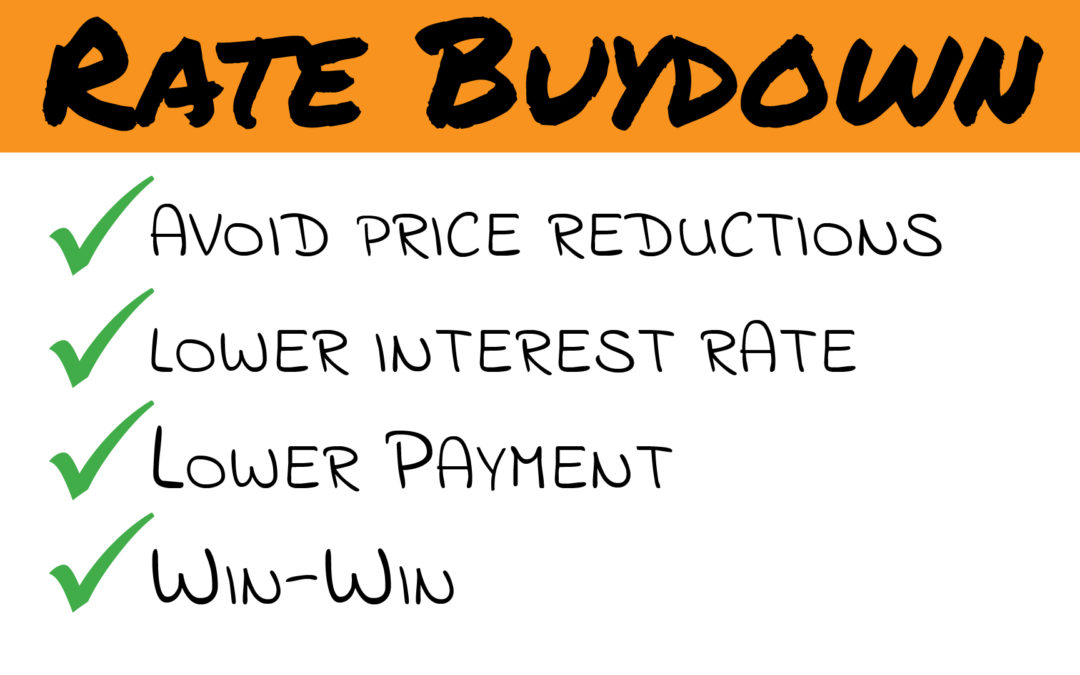

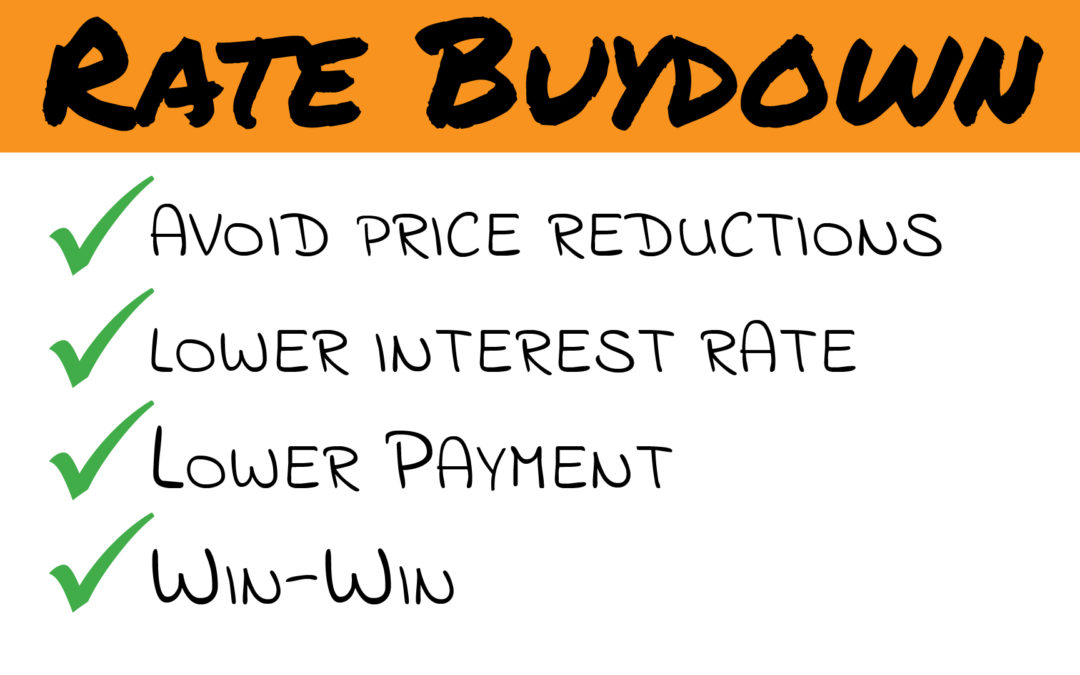

Learn WHY it’s Important to Know and Educate Buyers and Sellers, WHAT it is and HOW it works. Avoid Price Reductions & Give Your Buyer Access to Below Market Wholesale Rates With rates going up more sellers are dropping their prices. Don’t let your seller make...

by garrick | Sep 19, 2022 | 411

The real estate market is cooling fast! It has been a sellers’ market for a long time. This is when there are a lot of buyers competing for the same house of course, which drives values up. People are bidding and over bidding, especially in areas like California and...

by jessicajones | Sep 13, 2022 | 411

With mortgage interest rates spiking as fast as they did earlier this year, there has been a dramatic shift in the housing market and a lot of sellers are facing price reductions. A great strategy to avoid a price reduction is the seller buydown. How this works is...

by jessicajones | Aug 22, 2022 | 411, Uncategorized

This is the big buzzword right now among in-house lenders, I know. Why not give your sellers and buyers access to lower wholesale rates to begin with? What Is A Seller-Paid Rate Buydown? This is when the seller gives the buyer a credit to help “buy down” the...

by jessicajones | Jul 21, 2022 | 411

The 7/6 ARM is becoming increasingly popular since rates have ticked up. Here are some basics you should know before signing off in a 7/6 ARM. 1. The Adjustable Rate Change After Fixed Period Since the initial interest rate is only fixed for 7 years, the future rates...

by jessicajones | Apr 28, 2022 | 411

Inflation is the big buzz word in 2022 and how quickly times have changes in the mortgage world. We are seeing huge lender like Rocket and Better.com with tremendous layoffs with the new frontier we enter now that rates are up a good 1.5-2% above where they were over...

Recent Comments