Library

Digital 411

FHA 5/1 ARM – More Buying Power, Same Low Down Payment

I wanted to share a quick story that might help you with your next buyer on the edge of qualifying… A few weeks ago, I had a client who fell in love with a home—but when we ran the numbers, her debt-to-income ratio (DTI) was just a little too high. She was already...

Beast Mode Prospecting in the Age of AI

Beast Mode Prospecting in the Age of AI PowerStack Edition In the Age of Giant Real Estate and Mortgage Tech Mergers (like Rocket & Redfin), independent agents and brokerages face increasing pressure to compete. Standing out requires a strategic, high-impact...

The Ultimate Guide to ITIN Loans

What is an ITIN Loan? An ITIN loan is a mortgage designed for individuals who file taxes using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number. The ITIN is issued by the IRS for those who are not eligible for an SSN but still...

Fix & Flip Loans: 10% Down & 100% Rehab Financing – How It Works

Fix & Flip Loans: 10% Down & 100% Rehab Financing – How It Works Imagine this—you’ve got an amazing fix & flip opportunity and cash from an investor lined up. The numbers are perfect, you’ve lined up contractors, and you're just days from closing. Then,...

Unlocking Off-Market Properties with AI: A 7-Day Roadmap Powered by Grok3

Agent Animals Real Estate Boot Camp! On the next episode of Agent Animals, Frank Garay, Real Estate Tech Junky and National Show Host, explores how to tap into off-market properties using a 7-day roadmap powered by X-AI’s Grok3. Learn how to leverage local networking,...

Loan Solutions Tailored for You – Fresh Home Loan Inc.

At Fresh Home Loan Inc., we understand that every homebuyer, investor, and homeowner has unique financial needs. Whether you're purchasing your first home, expanding your real estate portfolio, refinancing for better terms, or funding a renovation, we have the right...

Simply Solar Loan: The Ultimate Solar Financing Solution

Simply Solar Loan: The Ultimate Solar Financing Solution 🌞 Electric bills are doubling, insurance costs are rising, and mortgage rates remain high—but there’s one bright spot: solar energy. Whether you’re looking for a solar-specific loan, leveraging your home equity,...

Save Big with a 1-0 Buydown – Lock in Savings Today!

Since the rise of rates in 2022, Since the rise of mortgage rates in 2022, lowering rates has been the hot topic for home buyers and sellers alike. Imagine starting your homeownership journey or refinancing your current loan with a rate 1% below market for the entire...

How to Beat All Cash Offers in the Bay Area and California

In high-paced markets like the San Francisco Bay Area, closing your real estate transaction fast can be essential to getting your offer accepted by the seller. That is why WHO you get approved with is just as essential. At Fresh Home Loan Inc., we fully pre-approve...

Self-Employed Bank Statement Loans: Unlocking Opportunities for Business Owners

Being self-employed is empowering—it offers flexibility, autonomy, and the chance to follow your passion. However, when it comes to securing a mortgage, self-employed individuals often face unique challenges. Enter bank statement loans, a solution designed...

Close Your Real Estate Transaction in 15 days “Same as Cash”

“15 Days Same as Cash”: What You Need to Know In fast paced real estate markets, like the San Francsico Bay Area, speed and flexibility are key. Whether you're a first-time homebuyer, a seasoned investor, or a real estate agent working to close deals faster, having...

Introducing the New DSCR 5-8 Program: Empowering Investors to Scale Up

Investors, take note: Fresh Home Loan Inc’s DSCR (Debt-Service Coverage Ratio) program has expanded, bringing incredible opportunities for those looking to maximize returns on residential investments. The new DSCR 5-8 Program is tailor-made for properties with 5 to 8...

Unlocking California Homeownership: Down Payment Assistance Programs in California

For many aspiring homeowners, saving for a down payment can be a significant challenge. Fortunately, California offers a variety of Down Payment Assistance (DPA) programs designed to bridge the gap and make homeownership more accessible. Whether you're a first-time...

Delayed Financing: What It Is and How It Can Benefit Investors and Homebuyers in General

When purchasing a home, speed can be king in competitive markets like The San Francisco Bay Area, and Cash is King when writing offers! One strategy that’s growing in popularity among savvy buyers is delayed financing. Whether you're a real estate investor or a...

Introducing MoveTube: Revolutionizing Real Estate with Streaming and AI

At MoveTube, we leverage cutting-edge streaming technology and AI tools to enhance your brand and give you the edge in winning listings. Here’s how we empower real estate agents like you: Branded Agent Tools: Video Trailers & Slideshows: Show off your properties...

Special Mortgage Solutions for Medical Professionals

Look after your financial health with a specialty home loan. Managing your financial health is crucial, especially when pursuing a career in medicine. The unique demands of medical training and practice can sometimes make homeownership seem out of reach, but there’s a...

So, What Exactly Does a REALTOR Do For You?

"By all accounts, the general public is not aware of all the services that agents provide to sellers and buyers during the course of the transaction, probably because most of the important services are performed behind the scenes." Pre-Listing Activities Make...

Lowest Mortgage Rates of The Year Present Opportunity Ahead of Anticipated Changes

Mortgage rates have reached their lowest point this year, presenting new opportunity for homebuyers and those homeowners looking to refinance. This significant drop in rates offers a prime moment to lock in favorable terms before anticipated changes in the market....

Unlocking the Benefits of Reverse Mortgages: A Comprehensive Guide to Making Informed Decisions

Today we are taking a dive into the world of Reverse Mortgages. Navigating the landscape of reverse mortgages can be daunting for many senior homeowners, or children of aging parents. With the promise of converting home equity into a secure living situation for...

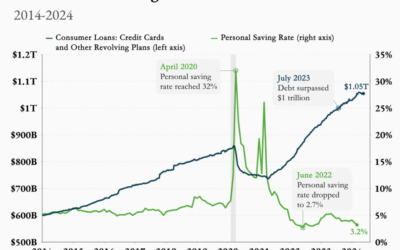

Is it a Good Idea to Consolidate Credit Card Debt with a Cash Out Refinance?

Consolidating credit card debt into a cash-out refinance can be a strategic financial move under certain circumstances. Here are some reasons why someone might consider this option: Lower Interest Rates: Credit cards often come with high interest rates, sometimes...

Understanding Loan and Appraisal Contingencies in the San Francisco Bay Area and California and Beyond

When you’re making an offer on a property in California (or anywhere!) It’s essential to understand loan and appraisal contingencies. Loan Contingency A loan contingency gives the buyer a specific period to secure financing for the property. If they can’t get a loan...

Introducing Project Open House 2.0: Simplifying Open House Success

We are dedicated to assisting our Realtor partners and maximizing the leads that come in from an open house. We are well know for our follow-up of cold leads. We understand that 15% of the buyers at an open house will buy in the next 90 days and the other 85% will buy...

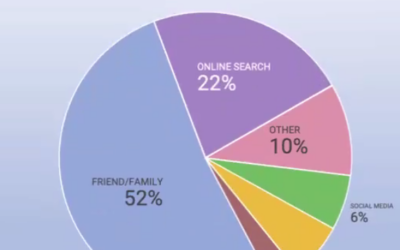

Social Media VS Google Search for Real Estate Professionals

I was doing some research the other day, looking at some real estate profiles on Google and I found that many of the partners we work with don’t have their own google profile. These particular people I am talking about are very active on social media, so I found it...

What is Private Money and Why is it Called Hard Money?

Have you ever come across the term "Hard Money loan"? It might sound a bit intimidating at first glance. However, Private Money Loans, also known as Hard Money loans, are specifically tailored for financing real estate transactions in unique situations. So, why the...

Expanding Your Real Estate Portfolio Through Private Money or Hard Money in California

As an “Independent Mortgage Broker that Works for the People”, Private Money, or HARD MONEY is in constant demand. Garrick Werdmuller, President and CEO of Fresh Home Loan has been brokering Private Money deals since 2008. “Back then, many investors could only get...

How to Get Preapproved for a Home and WIN in Markets Like the San Francisco Bay Area & California

The Fresh Home Loan Home Buyers Concierge Program is an exclusive program from Fresh Home Loan Inc. California’s Premier Mortgage Brokerage. We have been working with First Time Home Buyers, Move Up Home Buyers, Move Down Home Buyers, and Investors for 20+ years and...

Unlocking Potential: The Rise of Accessory Dwelling Units in the Bay Area and How to Navigate Financing Options.

The San Francisco Bay Area, known for its stunning landscapes, technological innovation, and cultural diversity, faces a growing challenge in its housing market. As housing costs soar and urban spaces become more limited, residents and policymakers alike are exploring...

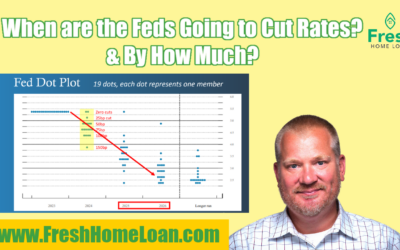

When Are The Feds Going To Cut Rates And By How Much?

We've all been anticipating the ripple effects of the Fed's rate cuts, and the real estate market is buzzing with excitement for what lies ahead in 2024. The big question on everyone's mind is not just when these rate cuts will happen, but by how much? Let's delve...

Unlock Your Dream Home: Exclusive Mortgage Offer in California with The 1-0 Buy Down and $600 Appraisal Credit!

Are you in the market for a new home or looking to refinance your existing mortgage? Now is the perfect time to seize an incredible opportunity with The 1-0 Buy Down and enjoy a special $600 Appraisal Credit until March 31, 2024. This exclusive offer is brought to you...

Unlocking Potential: The Rise of Accessory Dwelling Units in the Bay Area and How to Navigate Financing Options

The San Francisco Bay Area, known for its stunning landscapes, technological innovation, and cultural diversity, faces a growing challenge in its housing market. As housing costs soar and urban spaces become more limited, residents and policymakers alike are exploring...

The Fresh Home Loan Home Buyers Concierge Program

The Fresh Home Loan Home Buyers Concierge Program The Fresh Home Loan Home Buyers Concierge Program is an exclusive program from Fresh Home Loan Inc. California’s Premier Mortgage Brokerage. We have been working with First Time Home Buyers, Move Up Home Buyers, Move...

The Cash Out Refinance Book: Get Your Complimentary Copy!

The Cash Out Refinance Book: Unlock the Hidden Value in Your Home! The Cash Out Refinance Book: What Is a Cash Out Refinance? Exciting news, we have just released the Cash Out Refinance Book where you can get all your questions answered. FOR FREE About the benefits...

Why Does Getting a Home Loan Have to Be Such a Pain in the @$$???

Why Does Getting a Home Loan Have to be Such a Pain in the @$$??? I came up with this after this client told me the story of dealing with a Big Bank and the largest online lender in the nation and having such a terrible experience, she didn’t even want to talk to me....

California Dream For All Shared Appreciation Loan UPDATE 2024

It is True! The Legislature passed, and Governor Gavin Newsom signed into law, the 2023-24 State Budget which provides $200 million for the CalHFA Dream for All Shared Appreciation Loan program!!! CalHFA will continue working with partners in State government and...

United Wholesale Mortgage is the #1 Lender in the nation so how do you get a loan with them?

United Wholesale Mortgage is the #1 Lender in the nation so how do you get a loan with them? Today we are talking all things United Wholesale Mortgage or UWM. The #1 Mortgage Lender in the Nation.But you can’t just call UWM to get a loan so who are they and how do you...

4 Reasons Why You Shouldn’t Wait for Mortgage Rates to Drop

In August there was a definite sourness in the real estate market, for both buyers and sellers, with the rise of mortgage rates to multi-decade highs. What potential home buyers don’t realize, at least many of them is when they do “get off the fence” with lower rates,...

Nurturing Connections with Home Buyers – The Power of Project Open House from Fresh Home Loan

Nurturing Connections with Home Buyers – The Power of Project Open House from Fresh Home Loan What is Project Open House? Essentially Project Open House is a sign in sheet and a $25.00 gift card and a solid follow up campaign for those “tepid” open house leads. How...

Home Equity Line of Credit in 5 Minutes with No Hard Credit Check

Home Equity Line of Credit in 5 Minutes w No Hard Credit Check #realestate Fixed or Adjustable Home Equity lines of Credit – Approved in 5 minutes with Hard Credit Check In a looming environment of high debt, Fresh Home Loan Inc., in Alameda, Ca. has access to a...

1 TIME CLOSE Construction Loan from Fresh Home Loan

Fresh Home Loan inc., in Alameda Ca., has a very unique loan that we are discussing today and it is the 1 TIME CLOSE time close construction loan. This is a great loan for Realtors that sell a lot of land, builders and contractors, and even land owners looking to...

What Interest Rate are you Really Paying?

If you have a mortgage with a low rate, that’s awesome! But what if you have other debts? According to Lending Tree: Americans’ total credit card balance is $986 billion in the first quarter of 2023, according to the latest consumer debt data from the Federal Reserve...

The 0% Interest Rate Bridge Loan

Are you looking to move up, or move down but your downpayment is tied to the equity in your current home? Bridge Loans are a big deal right now with inventory being so tight. What is a bridge loan? Purchase Bridge Loans: are used when a borrower wants to purchase a...

5 Day HELOC

WHAT??? 5 Day HELOC – Fixed or Adjustable - Tap Into Your Equity Not Your 1st Mortgage Are you looking to tap into your equity, but you don’t want to mess with your low fixed rate first mortgage? We have a new product that can fund in as fast as 5 days! It’s a Home...

The Real Time Referral Program

Leads Are Seeds! The Real Time Referral Program Explained! Hi! Thanks for watching this short video that discusses our Real Time Referral program. I promise it will be a great use of your time! I appreciate you and look forward to growing a “Forest of Oak Trees” with...

Zero Down Financing with No Income Restrictions!

Fresh Home Loan Inc. Announces a Zero Down Home Loan with No Income Restrictions for California "While the housing market has its challenges for many buyers and sellers, one thing to realize is the opportunity this market has for the first-time homebuyer” — Garrick...

HomeOne® – A Great Little Known Home Loan for First Time Home Buyers

Introduced in 2018, Freddie Mac’s HomeOne® mortgage loan is designed to make financing more accessible for prospective home buyers as well as refinance. Another thing that is truly unique is it allows ‘Border Income’. This is rent received from a roommate. You can...

Trigger Leads and How To Deal With Them

Trigger Leads and How To Deal With Them Let's assume one is looking to buy a home. They call Fresh Home Loan, a local mortgage brokerage, and Broker Owner Garrick Werdmuller does his due diligence in running credit and approving your loan and THE NEXT DAY YOU HAVE...

5 Reasons Why ‘No Doc’ Investment Loans are a Great Idea – Also known as a Debt Service Coverage Loan or DSCR Loan.

What is a Debt Service Coverage Loan? There is a lot of talk about ‘No Doc’ Investment Loans these days. Now, this is not some Sub Prime Loan from 2006 that allows for a blank application, and you get the loan. This is a loan that is qualified by the subject property...

Winter is Coming! Are YOU Ready? Zero Down Loans Private Money Loans Self Employed Loans Investor

https://youtu.be/gHAUQD9KJNs We are doing an AWESOME event on November 17th 2022 On Facebook: https://fb.me/e/3W3sSwMfC Winter Is Coming! With the current shifts in the real estate market, you need to maximize every opportunity you have with Alternative...

Live Event: Wholesale Buydown Program | September 23rd & 30th at 10am PST

Learn WHY it’s Important to Know and Educate Buyers and Sellers, WHAT it is and HOW it works. Avoid Price Reductions & Give Your Buyer Access to Below Market Wholesale Rates With rates going up more sellers are dropping their prices. Don’t let your seller make...

Home buyers Are in CONTROL AGAIN! The Three Things You Need to WIN in THIS Market!

The real estate market is cooling fast! It has been a sellers’ market for a long time. This is when there are a lot of buyers competing for the same house of course, which drives values up. People are bidding and over bidding, especially in areas like California and...

Fresh Home Loan Inc. President, Garrick Werdmuller Explains What A Seller-Paid Rate Buydown Is?

With mortgage interest rates spiking as fast as they did earlier this year, there has been a dramatic shift in the housing market and a lot of sellers are facing price reductions. A great strategy to avoid a price reduction is the seller buydown. How this works is...

What Is A Seller-Paid Rate Buydown?

This is the big buzzword right now among in-house lenders, I know. Why not give your sellers and buyers access to lower wholesale rates to begin with? https://www.youtube.com/watch?v=jGRKu8Uol8I What Is A Seller-Paid Rate Buydown? This is when the seller gives...

The 7/6 ARM Mortgage. What is it and why is it so Popular?

The 7/6 ARM is becoming increasingly popular since rates have ticked up. Here are some basics you should know before signing off in a 7/6 ARM. https://www.youtube.com/watch?v=haum2VJg9kc 1. The Adjustable Rate Change After Fixed Period Since the initial interest rate...

Rates, Real Estate, and Recession

https://youtu.be/Gna924dUeGk Inflation is the big buzz word in 2022 and how quickly times have changes in the mortgage world. We are seeing huge lender like Rocket and Better.com with tremendous layoffs with the new frontier we enter now that rates are up a good...

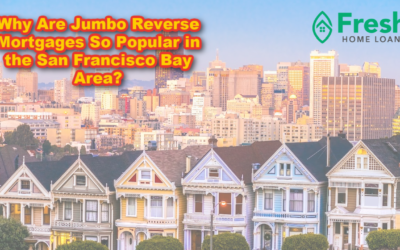

Why Are Jumbo Reverse Mortgages So Popular in the San Francisco Bay Area?

https://www.youtube.com/watch?v=nrBfj2CfyOE There was a time when jumbo reverse mortgages received a bad rap amongst consumers, but over the last decade, jumbo reverse mortgages have evolved to become one of the more popular financing vehicles for borrowers throughout...

Can Your Mortgage Broker Do It All, Even Reverse Mortgages?

https://www.youtube.com/watch?v=JmLBOpG7J1U Talking to an independent mortgage broker for your next purchase or refinance, or reverse mortgage is always a good decision. In fact, recent data shows that many borrowers are turning away from the bigger banks in favor of...

Five Retirement Housing Options Worth Exploring

Everyone wants to hit that milestone where you can hang up your work boots and retire from the daily grind. The problem is that many Americans fail to adequately prepare for this pivotal life change. Recent data suggests that nearly 35% of people have little or no...

How to Sell a Home with a Reverse Mortgage

When you first applied for your reverse mortgage, you were probably trying to plan ahead for your future, with long-term goals in mind. But no matter how much you plan, life can throw you an unexpected curveball, changing things down the road. Whatever the...

The History or the Reverse Mortgage

While the concept of a mortgage has been around for centuries, the modern mortgage didn’t really take footing in America until the late-1800s. While traditional mortgage financing has certainly evolved since its original inception, reverse mortgages have had a much...

A Step-By-Step Guide to Getting a Reverse Mortgage

For years borrowers have been leveraging reverse mortgages to help consolidate debt, eliminate their monthly housing payment, and even fund retirement. In fact, home equity conversion mortgages (HECM) have become increasingly popular over the last decade. But if you...

5 Reasons Why Getting a Reverse Mortgage is a BAD Idea

Companies spend a lot of money making reverse mortgages sound appealing, but the truth is that getting a reverse mortgage isn’t always the best idea. For years reverse mortgages have been championed as a great way for you to fund your retirement (if you are of...

Top 5 Reasons Why Getting a Reverse Mortgage is a GOOD Idea

No one ever said that life is easy, fair, or even that it comes cheap. In fact, the cost of living has been incrementally increasing over the years making it that much harder for individuals to afford even the basic necessities. But if you are a homeowner where...

The Impacts of the Ukrainian-Russian Conflict on Mortgage Interest Rates

https://www.youtube.com/watch?v=HWgymB_88Sk As news of the Ukrainian-Russian conflict continues to shock the world, domestic borrowers and investors alike have grown rapidly concerned with the macroeconomic impact the war might have on the U.S. housing market. Before...

The Federal Reserve has raised its benchmark rate for the first time since 2018

https://www.youtube.com/watch?v=uBBqNe4C1yg The Federal Reserve's move to boost its short-term target rate by a quarter percentage point was widely expected. The Fed said the FOMC "anticipates that ongoing increases in the target range will be appropriate." "In...

What is a Home Equity Line of Credit?

A home equity line of credit, or HELOC, is a second mortgage that gives you access to cash based on the value of your home. You can draw from a home equity line of credit and repay all or some of it monthly, somewhat like a credit card. With a HELOC, you borrow...

Home Equity Lines of Credit now available at Fresh Home Loan Inc, the East Bay Area Mortgage Broker

With rates ticking up, yet Home Equity is at an all-time high, now is the perfect time to get a Home Equity Line of Credit!

10 Steps to Opening your Own Mortgage Brokerage

As I write this, I have been a mortgage originator for 21 years now and yes it has been a wild ride, but I have to say overall, it has been a blast! In 2021 I finally opened Fresh Home Loan Inc., “Independent Mortgage Brokers that Work for the People” ™....

First time Home Buyers – Is It Too Late to Buy a Home?

2021 has been a banner year for housing, fueled by record low interest rates, strong demand, and a low supply of homes. https://youtu.be/JFsZ0419iQs You may be wondering if you are late to the party, or if it’s still a good time to purchase. Experts...

As Rates Creep up in 2022 the FHFA Hikes Fees for High-Balance and Second-Home Loans!

The FHFA announced some pretty dramatic fee increases for high balance and second home financing. They are implementing loan-level price adjustments on April 1st, 2022 that affect home buyers and homeowners in high-cost areas like the San Francisco Bay Area and people...

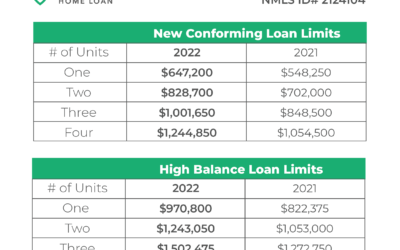

First Time Home Buyers – What do the New 2022 Conforming Loan Limits Mean to You?

What do the new 2022 conforming loan limits mean to First Time Home Buyers? The new loan amounts are here, and they are HUGE! Originally, we thought the conforming loan amount was going to be 625K but as we mentioned before they are up to $647,200 and High balance is...

The New 2022 Loan Amounts are Here!!!

https://www.youtube.com/watch?v=lMCxh50FkDU&t=13s

Appreciation + Low Rates = Opportunity

https://youtu.be/p7JxPWV6uH0 Mortgage Review- Putting your home equity to work for you. While there may be signs of the real estate slowing down in certain areas that is not the case here in the Bay Area, we are still seeing multiple offers. I saw a house...

Self Employed Home Loan Checklist – “Post” Pandemic

Since Covid, there have been more requirements for self employed borrowers as well as W2’s employees as well What you don’t want to do is lie and say you are W2’d when you are self-employed. Also, it is best to get what is required rather than make a fuss about it....

The Truth about Online Reverse Mortgage Calculators

Are you looking online for a Revere Mortgage Calculator to find out how much you or a loved one might qualify for? Well, the truth is the answer is pretty easy to get, all you need is a: Property Address Date of Birth And we can run different scenarios for you with...

Are There Jumbo Loans For First-Time Home Buyers?

What is the Annual Percentage Rate (APR) and Why is it Flawed?

What is the Annual Percentage Rate (APR) and Why is it Flawed? An annual percentage rate (APR) reflects the mortgage interest rate plus other charges. There are many costs associated with taking out a mortgage. -These include: ♣ The interest rate ♣ Points ♣ Fees ♣...

Refinancing in California Just got ALOT Cheaper

On July 16th, 2021 the FHFA announced they are removing something we complained about in August – the FHFA adverse Market fee. Basically, a 50 basis point charge, that was announced out of the blue last summer, to consumers looking to refinance when we were...

Why NOW may be the time to Lock in that Mortgage rate if you have not Already

Why NOW May be the Time to Lock in that Mortgage Rate…We have seen mortgage rates rally pretty big time over the past few weeks, AND, we have also seen a lot of talk about the feds tapering mortgage-backed securities. Federal Reserve Bank of Dallas President Robert...

Biden Fires Calabria and Hires Thompson – What is Next for Your Mortgage and the FHFA?

The director of the FHFA, Mark Calabria, who was appointed by President Donald J. Trump was fired by Joe Biden Wednesday June 23rd after the Supreme Court Ruled that Congress made the FHFA too insulated from the White House because the president couldn’t easily remove...

Mortgage Rates “Taper” w Fed Announcement?

The Fed finally Acknowledging inflation after being very transitory and admitting we are going to see inflation around 3.4% towards the end of the year.

Fannie Mae RefiNow – 4 Loan Approvals We Could not do in 2020!

Great News! We JUST got approvals for 4 borrowers that had debt to income issues that were too high in 2020 and I think we are about to get 2 more. Here is the deal… Fannie Mae Announces RefiNow – Expands Eligibility to Help More Homeowners Reduce Their Monthly...

Home Buying and a Global Pandemic – A Crazy New World

The mortgage business while extremely busy right now is full of challenges. Take on those, open a mortgage brokerage with a reverse mortgage division, and write a book and you have my start to 2021 dialed in! I am very proud to announce I wrote a book Home...

Appraisals 2021 They Will Take Longer, Be More Expensive, Come in Low???

Between an aging appraiser society, Shelter in Place, and low interest rates appraisals can arguably be the biggest challenge today when buying or refinancing a home. We are seeing extremely long turn times, rising costs and with the bidding wards going on, they are...

Finally!!! Jumbo Purchase Loans, Easy Underwrite! I am FIRED UP! 2 conditions not 2 pages of!!!

Finally!!! Jumbo Purchase Loans, Easy Underwrite! I am FIRED UP! 2 conditions not 2 pages of conditions! A Few approvals in now and this program is amazing! 2 or 3 conditions instead of 2 or 3 pages! Realtor’s and Homebuyers…. You may want to rethink that strategy of...

United Wholesale Mortgage vs Rocket Pro TPO – the Battle of the Wholesale Mortgage Giants

https://www.youtube.com/watch?v=LfviqfD_9T0&feature=youtu.be The Wholesale Mortgage World was turned upside down on March 5th when President and CEO of UWM Mat Ishbia the largest wholesale lender in America went on Facebook and told the Mortgage broker world if...

Investment Properties and Second Homes just got WAY more Expensive to Purchase and Refinance!

Another 2021 Shocker in the Mortgage World announced on March 10 2021. Second homes and investment properties will be taking a HUGE hit! https://www.youtube.com/watch?v=2HSTGfemXSE Fannie Mae came out with an announcement on March 10, 2021 stating: Recent amendments...

Home Purchase Pre-Approval Letters

Fresh Home Loan Changing the Game for Agents and Home Buyers Never before has a pre-approval letter been so important. Not only do you need one to write offers but more often than not, you need one just to get into a home. It can be a hassle to have...

Mortgage Rates on the Rise in 2021

The conforming 30 year fixed mortgage rates are going up probably going to level off between 3.25 and 3.75 which is a big jump from the mid 2’s we saw just a few weeks ago and everybody wants to know why? The short answer? The economy is improving, and rates go down...

The Fresh Home Loan Housing and Interest Rate Outlook for 2021

Housing and Interest Rate Outlook for 2021 Between the Pandemic Politics Stocks and now Mortgage rates 2021 is off to the races! As far as our housing outlook for 2021, here we go… Janet Yellen, former Fed Chair is now treasury secretary. She is quite different than...

What is G.O.S.P.A.?

G.O.S.P.A is a strategy planning technique I was turned on by an industry friend and I thought it was a really great concept. G.O.S.P.A. is an acronym and it refers to Goals, Objectives, Strategies, Plans/ Priorities, and Actions. [yotuwp type="videos"...

Lower Rates, Faster Turn Times, and Better Qualified Borrowers, Broker or Bank?

United Wholesale Mortgage released some data recently looking at the current industry challenges and a comparison of retail and wholesale originations. Industry turn-times are the...

Mortgage Rates and The Feds Confusing Message

We are days before the FHFA hits you with the adverse market fee. This is a 50-basis point fee that will increase rates for the consumer roughly .125-.375 as I discussed last month. The FHFA says it’s to counterbalance the looming 6 billion in forbearance etc. but...

Private Money Lending

Private Money is a commonly used term in banking and finance. It refers to lending money to a company or individual by a private individual or organization. While banks are traditional sources of financing for real estate, and other purposes, Private Money...

COVID-19 and Real Estate Appraisal Challenges

https://youtu.be/28uVhAOlGr8 Today we’re talking to David Schute with Home Appraisal Valuations Appraisal Management Company. David discusses the climate with appraising properties during a global pandemic and some of the challenges appraisers and the real estate...

What the HECK is Going On With the IRS???

https://youtu.be/dob2jknmQbY Today we are here with Coree Cameron Cameron CCK Corp https://cckcorp.com/ talking about the IRS and what is going on during the shutdown.

Introducing Conquest for REALTORS® – Mortgage Rates in the 2’s for Home Buyers!!!

https://www.youtube.com/watch?v=qf_yRgaQDaE Are you a REALTOR® looking to explode your business for the rest of 2020? We have an exclusive program for conventional home buyers called Conquest! This is a conventional loan program that has rates in the 2’s! This is a...

Investing your Money Safely during a Global Pandemic with John Reising, Reising Financial

https://www.youtube.com/watch?v=7q6Qw-k02A8 We are super lucky to have John Reising as our guest today. John is in the top 1% in the nation of financial investors that deal with fixed annuities. John tells us about his product for clients looking to make conservative...

Introducing Conquest – Mortgage Rates in the 2’s!!!

https://www.youtube.com/watch?v=0tA9m77LhoE Mortgage Rates have been all over the place over the last few months. Fortunately, we have been approved for a temporary program, exclusive to wholesale lenders, called Conquest. These are loans with rates in the 2’s!!!...

Who is Garrick Werdmuller? Fresh Home Loan?

https://www.youtube.com/watch?v=tSGymduOrL4 We are here to help you with your home financing during these unprecedented times. While banks are changing guidelines and loan programs daily, we know who the right fit for your home loan is and will help you navigate...

The CORONAVIRUS and your MORTGAGE

https://www.youtube.com/watch?v=Dzdfg1fdtUw A lot of crazy press out there! Everything is closing and cancelling, from sporting events to schools. All this has created panic in the financial markets and opportunity for homeowners looking to refinance. BE SAFE! First...